Trust Foundations: Trustworthy Solutions for Your Building and construction

Trust Foundations: Trustworthy Solutions for Your Building and construction

Blog Article

Securing Your Assets: Trust Fund Structure Competence within your reaches

In today's complex monetary landscape, making certain the security and growth of your assets is critical. Depend on structures offer as a keystone for safeguarding your wealth and heritage, providing a structured approach to asset protection.

Significance of Count On Foundations

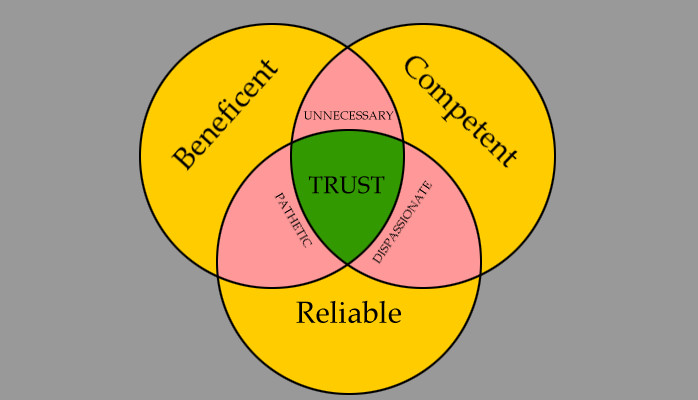

Depend on structures play a vital duty in developing reliability and promoting strong connections in different professional settings. Building trust is essential for businesses to thrive, as it forms the basis of effective collaborations and partnerships. When trust is present, people really feel a lot more positive in their interactions, leading to increased performance and performance. Trust foundations offer as the keystone for honest decision-making and transparent interaction within companies. By prioritizing trust, organizations can develop a positive work culture where employees really feel valued and valued.

Benefits of Professional Support

Structure on the foundation of count on expert connections, seeking professional support uses very useful advantages for people and companies alike. Specialist support provides a riches of knowledge and experience that can aid navigate complicated monetary, legal, or calculated difficulties easily. By leveraging the know-how of specialists in various fields, individuals and organizations can make enlightened choices that line up with their goals and goals.

One significant advantage of specialist support is the ability to access specialized expertise that might not be easily available or else. Professionals can use insights and perspectives that can bring about ingenious services and opportunities for growth. Additionally, functioning with professionals can assist mitigate threats and uncertainties by providing a clear roadmap for success.

In addition, specialist support can save time and sources by improving procedures and avoiding pricey errors. trust foundations. Professionals can use customized advice customized to specific requirements, guaranteeing that every choice is well-informed and critical. On the whole, the benefits of specialist assistance are complex, making it a useful asset in securing and making the most of properties for the long-term

Ensuring Financial Safety

Guaranteeing economic protection entails a complex strategy that incorporates different elements of riches management. By spreading investments throughout various possession classes, such as stocks, bonds, genuine estate, and commodities, the risk of substantial economic loss can be alleviated.

Furthermore, maintaining a reserve is necessary to guard versus unforeseen expenses or revenue disruptions. Specialists advise alloting 3 to six months' worth of living expenditures in a liquid, easily obtainable account. This fund functions as a financial safety and security net, giving satisfaction during stormy times.

On a regular basis evaluating and adjusting economic plans in feedback to altering circumstances is likewise critical. Life occasions, market variations, and legislative adjustments can affect economic stability, emphasizing the value of ongoing examination and adaptation in the search of lasting monetary safety - trust foundations. By implementing these methods thoughtfully and constantly, people can fortify their monetary footing and work in the direction of a more protected future

Guarding Your Properties Efficiently

With a strong foundation in location for monetary security with diversity and emergency situation fund maintenance, have a peek at this website the next essential step is securing your properties successfully. Safeguarding possessions includes shielding your wealth from prospective dangers such as market volatility, financial declines, lawsuits, and unexpected costs. One reliable strategy is asset allocation, which involves spreading your investments across different possession classes to decrease danger. Expanding your profile can assist alleviate losses in one location by stabilizing it with gains in an additional.

In addition, developing a count on can supply a safe way to shield your possessions for future generations. Trusts can assist you control just how your properties are distributed, decrease estate taxes, and protect your riches from creditors. By carrying out these techniques and looking for professional recommendations, you can safeguard your properties effectively and protect your economic future.

Long-Term Possession Security

Long-term asset protection involves implementing measures to protect your assets from various threats such as economic downturns, lawsuits, or unanticipated life events. One important element of long-term asset protection is developing a trust fund, which can supply considerable advantages in shielding your assets from financial institutions and lawful conflicts.

Additionally, diversifying your investment portfolio is another key approach article for lasting property protection. By spreading your financial investments throughout various possession classes, sectors, and geographical areas, you can reduce the influence of market changes on your overall wide range. In addition, on a regular basis evaluating and updating your estate plan is vital to ensure that your properties are safeguarded according to your dreams in the future. By taking a proactive strategy to long-lasting property security, you can safeguard your wide range and offer economic safety and security on your own and future generations.

Verdict

In final thought, depend on structures play a crucial role in protecting assets and guaranteeing monetary safety. Professional support in developing and handling depend on frameworks is necessary for long-lasting possession protection.

Report this page